-

Thai train collapse puts Dhipaya on the hook as lead insurer

Dhipaya covers 60% of the risk, with Bangkok Insurance and Intra Insurance each covering 20% for the high-speed rail construction project in northeast Thailand.

-

-

Siddharth Verma joins Axa XL’s India underwriting team as assistant property underwriter

Mumbai-based Verma joins from Marsh India, where he had worked in the facultative reinsurance team for property and construction underwriting since February 2022.

Siddharth Verma joins Axa XL’s India underwriting team as assistant property underwriter

Mumbai-based Verma joins from Marsh India, where he had worked in the facultative reinsurance team for property and construction underwriting since February 2022.

Mumbai-based Verma joins from Marsh India, where he had worked in the facultative reinsurance team for property and construction underwriting since February 2022.

-

Victoria bushfires destory 228 homes, 700 structures after burning area five times the size of Singapore

Insurers have received 2,201 insurance claims from the fires, which have been raging since last week, mostly in Victoria, but also in New South Wales.

Victoria bushfires destory 228 homes, 700 structures after burning area five times the size of Singapore

Insurers have received 2,201 insurance claims from the fires, which have been raging since last week, mostly in Victoria, but also in New South Wales.

Insurers have received 2,201 insurance claims from the fires, which have been raging since last week, mostly in Victoria, but also in New South Wales.

-

Chubb Singapore hires BHSI’s Cherry Gao as head of major accounts and global broking

She joins Chubb after almost a decade at Berkshire Hathaway Specialty Insurance (BHSI).

Chubb Singapore hires BHSI’s Cherry Gao as head of major accounts and global broking

She joins Chubb after almost a decade at Berkshire Hathaway Specialty Insurance (BHSI).

She joins Chubb after almost a decade at Berkshire Hathaway Specialty Insurance (BHSI).

-

Lockton takes majority stake in Malaysian joint venture

Lockton said the change reflects its commitment to Malaysia's 'important' market.

Lockton takes majority stake in Malaysian joint venture

Lockton said the change reflects its commitment to Malaysia's 'important' market.

Lockton said the change reflects its commitment to Malaysia's 'important' market.

-

Kulshaan Singh returns to Aon as APAC enterprise client leader

He was most recently group chief human resources officer at Thai Union Group PCL in Bangkok.

Kulshaan Singh returns to Aon as APAC enterprise client leader

He was most recently group chief human resources officer at Thai Union Group PCL in Bangkok.

He was most recently group chief human resources officer at Thai Union Group PCL in Bangkok.

-

Arch Insurance Australia adds Andrew Whitlock to casualty team

He has over a decade of experience in Australia and the UK.

Arch Insurance Australia adds Andrew Whitlock to casualty team

He has over a decade of experience in Australia and the UK.

He has over a decade of experience in Australia and the UK.

-

Bridging Asia’s protection gap key focus for Verisk, but data issue remains

US-based data analytics and risk assessment firm has inland flood models for Japan, and has recently released flood models for Malaysia and Indonesia, with plans to introduce a hail model for Japan and flood models for New Zealand and Australia.

Bridging Asia’s protection gap key focus for Verisk, but data issue remains

US-based data analytics and risk assessment firm has inland flood models for Japan, and has recently released flood models for Malaysia and Indonesia, with plans to introduce a hail model for Japan and flood models for New Zealand and Australia.

US-based data analytics and risk assessment firm has inland flood models for Japan, and has recently released flood models for Malaysia and Indonesia, with plans to introduce a hail model for Japan and flood models for New Zealand and Australia.

-

Cyber top APAC business risks in 2026 as AI surges to second place: Allianz Commercial

Both cyber and AI now rank as top five risks in every other region, and almost all the industry sectors analysed in the Allianz Risk Barometer report.

Cyber top APAC business risks in 2026 as AI surges to second place: Allianz Commercial

Both cyber and AI now rank as top five risks in every other region, and almost all the industry sectors analysed in the Allianz Risk Barometer report.

Both cyber and AI now rank as top five risks in every other region, and almost all the industry sectors analysed in the Allianz Risk Barometer report.

-

Sompo strengthens actuarial teams in Southeast Asia with key appointments

Victor Fung has been appointed certifying actuary for Singapore, while Joyce Oo has been hired as appointed actuary in Malaysia.

Sompo strengthens actuarial teams in Southeast Asia with key appointments

Victor Fung has been appointed certifying actuary for Singapore, while Joyce Oo has been hired as appointed actuary in Malaysia.

Victor Fung has been appointed certifying actuary for Singapore, while Joyce Oo has been hired as appointed actuary in Malaysia.

-

Sedgwick’s new Global Specialty platform ‘not just an expansion’

Global Specialty platform will be centred in London and led by the additions of Damian Ely as CEO and Kevin Hagan as COO, and will also include hubs in Asia, the Middle East, and the Americas.

Sedgwick’s new Global Specialty platform ‘not just an expansion’

Global Specialty platform will be centred in London and led by the additions of Damian Ely as CEO and Kevin Hagan as COO, and will also include hubs in Asia, the Middle East, and the Americas.

Global Specialty platform will be centred in London and led by the additions of Damian Ely as CEO and Kevin Hagan as COO, and will also include hubs in Asia, the Middle East, and the Americas.

-

Aon grows data centre lifecycle insurance program to US$2.5bn

Successful renewal reflects growing global demand for coverage of data centre related risks, according to Aon.

Aon grows data centre lifecycle insurance program to US$2.5bn

Successful renewal reflects growing global demand for coverage of data centre related risks, according to Aon.

Successful renewal reflects growing global demand for coverage of data centre related risks, according to Aon.

-

Asia natural catastrophe losses in 2025 contained by region’s protection gap: Howden Re

Peak perils accounted for a notably small share of the overall losses in 2025 due to a quiet Atlantic hurricane season, the broker said in its nat cat snapshot.

Asia natural catastrophe losses in 2025 contained by region’s protection gap: Howden Re

Peak perils accounted for a notably small share of the overall losses in 2025 due to a quiet Atlantic hurricane season, the broker said in its nat cat snapshot.

Peak perils accounted for a notably small share of the overall losses in 2025 due to a quiet Atlantic hurricane season, the broker said in its nat cat snapshot.

-

Non-peak perils show steady rise amid shifting climate patterns: Munich Re’s Tobias Grimm

Even as overall nat cat costs declined in 2025, reinsurer’s chief climate scientist tells InsuranceAsia News that climate change is intensifying risks in unexpected regions, underscoring the urgency of stronger resilience and preparedness measures worldwide.

-

Demand for marine war cover ‘on the radar’ despite pricing pressure

China’s war games and Donald Trump’s recent move in Venezuela and comments on Greenland suggest an uptick in enquiries for specialty insurance will persist in Asia in 2026.

-

‘A global problem’: Nicolas Maduro capture creates new dynamic for Asian geopolitical risks

Insurers have little real exposure to Venezuelan risks following the actions by the US, but it is not the case in other regions of the world, with Southeast Asia now a particular focus.

-

Indonesia eager for ‘continuous cooperation’ with London to open the door for Islamic insurance growth

Delegation from Indonesia’s Ministry of Finance and its financial regulator, the Indonesian Financial Services Authority (OJK), was in London last month for a meeting headed by International Underwriting Association CEO Chris Jones and Islamic insurance experts.

Between The Lines

A fortnightly podcast that unpacks the pivotal stories and trends shaping the (re)insurance industry across Asia Pacific.

Spotlight

-

Bridging Asia’s protection gap key focus for Verisk, but data issue remains

-

‘Asia is our playground’: Asia Reinsurance Brokers seeks winning formula to extend roots

-

Acord aims for ‘absolute sweet spot’ with Singapore roll out of digital messaging platform

-

Hong Kong to ‘anchor’ Sun Life’s APAC growth push after fantastic 2025: Manjit Singh

-

‘Enabling, not disrupting’: bolttech’s data-driven push to close the global protection gap

M&A

-

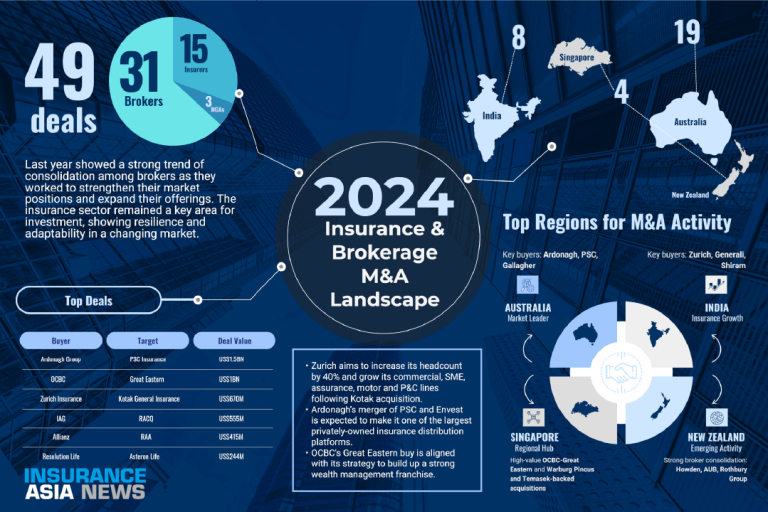

Lockton takes majority stake in Malaysian joint venture

-

Allianz nets US$2.45bn from sale of 23% of Bajaj JVs

-

‘Exporter of capital’ Japan here to stay, set to ignite APAC M&A in 2026

-

Hanwha General Insurance secures controlling stake in Indonesia’s Lippo General Insurance

-

Go Digit General Insurance board approves holding company merger

ESG

-

Carbon credit specialist Oka launches in Singapore

-

‘You can’t do it as a hobby’: ESG must be a clear business model with easily measurable targets

-

Carbon specialist Kita expands into Australia

-

Maritime decarbonisation efforts need liability certainty to stay on course amid ‘pressing challenge’

-

With Donald Trump’s ESG curveball, what’s the outlook for APAC liability coverage?

-

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

Cyber insurance has a long way to go to reach next level, says WTW’s Carlos Grijalva, amid soaring demand in Asia

Carlos Grijalva, cyber leader for Hong Kong and greater China at WTW, talks to InsuranceAsia News about the development of the cyber market in Asia.

Building resilience, mitigating risk in APAC’s commercial property insurance market

Martin Au-Yeung, vice president and division underwriting manager at FM, talks to InsuranceAsia News.

Marine: "Post-pandemic machinery-related losses have become an even more significant issue. Mechanical failures can undermine vessel safety, operational integrity, regulatory compliance, reputation, and even financial stability."

Bo Yu, Markel